Benefits Of Using Wells Realty And Law

Hello and thanks for joining us; I’m Chris and this is Jason; we’re both attorneys and realtors at Wells Realty and Law Group.. Today we’d like to introduce our team of real estate, legal and short sale experts to you as well as discuss some of the benefits you get with working with a team […]

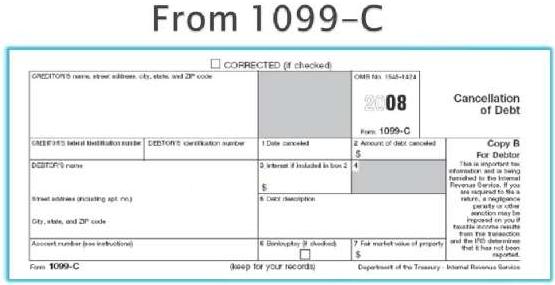

I received a 1099-C or a 1098…Now What? (VIDEO)

When a mortgage lender cancels or forgives a debt, as is often the case with a short sale or foreclosure, the “forgiven” amount of that loan is reported on a Form 1099-C which is sent to the borrower. Absent legal safeguards such as a state’s anti-deficiency statute, or the Mortgage Forgiveness Debt Relief Act, the […]

Insolvency Not Bankruptcy Protects Debt Forgiveness

As we all know by now, when an individual owes a debt to another person or entity and the debt is forgiven, the canceled debt may be taxable. In the past, this general rule has applied to debt forgiveness related to a short sale. In 2007, Congress passed the Mortgage Debt Forgiveness Act (“MDFA”). The […]

HELOC Liability After Foreclosure or Short Sale

Groups preying on distressed homeowners have found another angle for exploiting those who have lost their home. As if there was not enough already for distressed homeowners to concern themselves over, now those who have been through foreclosure or a short sale with a HELOC need to be on the lookout for persons and companies […]