I received a 1099-C or a 1098…Now What? (VIDEO)

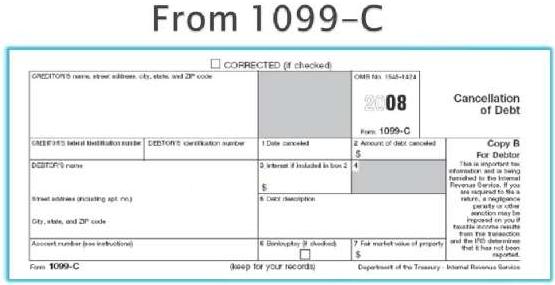

When a mortgage lender cancels or forgives a debt, as is often the case with a short sale or foreclosure, the “forgiven” amount of that loan is reported on a Form 1099-C which is sent to the borrower. Absent legal safeguards such as a state’s anti-deficiency statute, or the Mortgage Forgiveness Debt Relief Act, the […]

Mortgage Forgiveness Debt Relief Act and the Fiscal Cliff (VIDEO)

Many credit the Mortgage Forgiveness Debt Relief Act for much of the housing industry’s recovery in Arizona and throughout the country. Under the IRS Tax Code, debt cancellation or debt forgiveness, such as mortgage forgiveness in a short sale, is considered regular “income” for the taxpayer. Under the code a taxpayer would essentially have to pay taxes […]

Fiscal Cliff Impact on Arizona Real Estate Market and Values (VIDEO)

The Fiscal Cliff could greatly impact the investment sector of the Arizona housing market, and many should find the anti-deficiency statutes of the state provide more protection than originally thought. Real estate owners and investors need to be aware of the impending changes associated with the fiscal cliff, and keep a close eye on their investments, and […]

Mortgage Forgiveness Debt Relief Act May Get an Encore

In less than four months one of the clearest safeguards for Arizona’s distressed homeowners attempting a short sale is set to expire. The Mortgage Forgiveness Debt Relief Act of 2007 (“Act”) has made the choice between short sale and foreclosure a much easier one to make, and it may just stick around for an additional […]