I received a 1099-C or a 1098…Now What? (VIDEO)

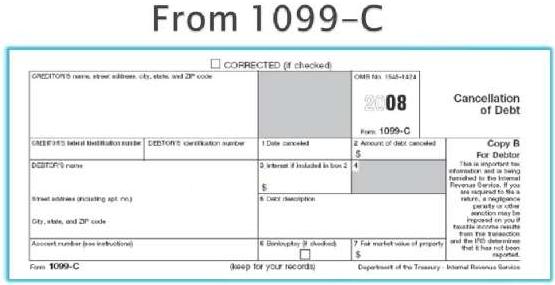

When a mortgage lender cancels or forgives a debt, as is often the case with a short sale or foreclosure, the “forgiven” amount of that loan is reported on a Form 1099-C which is sent to the borrower. Absent legal safeguards such as a state’s anti-deficiency statute, or the Mortgage Forgiveness Debt Relief Act, the […]

Self-Directed IRA and Real Estate Investments

With the increase in tax rates and the uncertainty in the stock market, many individuals with substantial amounts of cash in IRAs mutual funds, stocks, 401(k)s, and other investment vehicles are in an excellent position to take advantage of the benefits of self-directed IRA real estate investments for their retirement savings. What is a […]

Insolvency Not Bankruptcy Protects Debt Forgiveness

As we all know by now, when an individual owes a debt to another person or entity and the debt is forgiven, the canceled debt may be taxable. In the past, this general rule has applied to debt forgiveness related to a short sale. In 2007, Congress passed the Mortgage Debt Forgiveness Act (“MDFA”). The […]

Jury: Ex-IndyMac Execs Must Pay $169 Million for Negligent Loans + MORE

Three former IndyMac Bancorp Inc. executives must pay $169 million in damages to federal regulators for making negligent loans to homebuilders as the real estate market was deteriorating, a jury decided. The federal court jury in Los Angeles issued the verdict against Scott Van Dellen, the former chief executive officer of IndyMac’s Homebuilder Division; Richard […]