Lenders Have Fewer Options With Foreclosures, Allowing More Ex-Homeowners to Stay

– eforeclosuremagazine.com

The real estate market’s collapse in 2007 and subsequent foreclosure crisis over the last few years has taken its toll on millions of homeowners and former homeowners. Increasingly, though, another unusual class of individuals is feeling the weight of the crisis: lenders.

The real estate market’s collapse in 2007 and subsequent foreclosure crisis over the last few years has taken its toll on millions of homeowners and former homeowners. Increasingly, though, another unusual class of individuals is feeling the weight of the crisis: lenders.

In what some might call poetic justice, banks and lenders across the country are actually finding themselves with far fewer options when it comes to managing home foreclosures…

Whistleblower Lawsuits Against Banks Extinguished in Foreclosure Fraud Settlement

– implode-explode.com

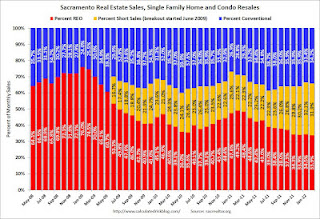

I’ve been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.This will be interesting once something changes significantly…

I’ve been following the Sacramento market to look for changes in the mix of house sales in a distressed area over time (conventional, REOs, and short sales). The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.This will be interesting once something changes significantly…

Nick Timiraos at the WSJ has some details about the settlement. He also writes that the settlement documents might be filed in court tomorrow.Here is the online site for the mortgage settlement. Note the “National Mortgage Settlement (coming soon)” in the upper right.

From Timiraos: Mortgage Deal Is Built on Tradeoffs

Settlement documents, which could be filed in court as soon as Monday, will detail the formulas governing how banks gain credit for that aid, as well as new standards banks will have to follow when they deal with borrowers who face or go through foreclosure…