I received a 1099-C or a 1098…Now What? (VIDEO)

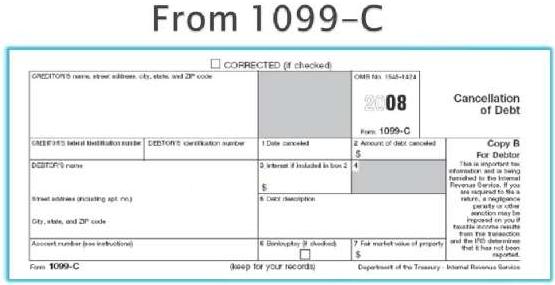

When a mortgage lender cancels or forgives a debt, as is often the case with a short sale or foreclosure, the “forgiven” amount of that loan is reported on a Form 1099-C which is sent to the borrower. Absent legal safeguards such as a state’s anti-deficiency statute, or the Mortgage Forgiveness Debt Relief Act, the […]