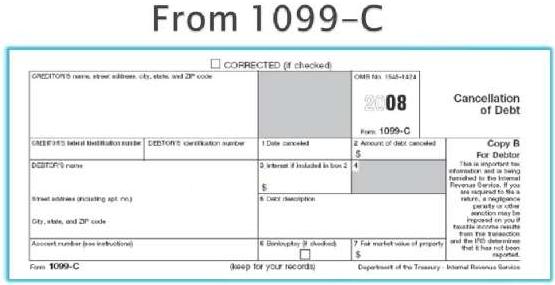

When a mortgage lender cancels or forgives a debt, as is often the case with a short sale or foreclosure, the “forgiven” amount of that loan is reported on a Form 1099-C which is sent to the borrower. Absent legal safeguards such as a state’s anti-deficiency statute, or the Mortgage Forgiveness Debt Relief Act, the borrower may be responsible for the taxes resulting from that forgiven debt.

Many of our clients have had questions regarding tax forms they have received from their lender(s). The most common two forms sent by the mortgage lender are the Form 1098 and Form 1099-C. These are two very different forms with two very different ramifications.

To help understand these forms we have made a short 2 minute video on the Form 1098 and Form 1099-C. To watch just click below…

For additional information on the Form 1099-C and the Form 1098, please click below:

Click Here to Watch an Additional Video on Form 1099-C

Click Here to Watch Additional Video on Form 1098

If you would like myself or Chris to review your 1099-C or 1098 please send it to docs@wellsrealtylaw.com with your last name and 1099-C or 1098 in the subject line (i.e. Smith 1099-C).

As always, we are here to help you and those you know. Before buying or selling real estate please have them contact us. Our Streamlined Solutions, and Internet Marketing Specialty gets any home sold through our trademarked Highest and Fastest System in less time and for more money than the typical agent — Guaranteed!

Jason Wells, Esq. & Chris Niederhauser, Esq., partners at the Wells Realty & Law Groups, are here to answer any of your real estate questions. Call us today at 480.428.3290 to review your real estate situation.