I received a 1099-C or a 1098…Now What? (VIDEO)

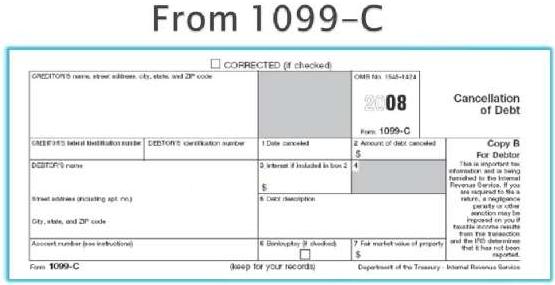

When a mortgage lender cancels or forgives a debt, as is often the case with a short sale or foreclosure, the “forgiven” amount of that loan is reported on a Form 1099-C which is sent to the borrower. Absent legal safeguards such as a state’s anti-deficiency statute, or the Mortgage Forgiveness Debt Relief Act, the […]

Self-Directed IRA and Real Estate Investments

With the increase in tax rates and the uncertainty in the stock market, many individuals with substantial amounts of cash in IRAs mutual funds, stocks, 401(k)s, and other investment vehicles are in an excellent position to take advantage of the benefits of self-directed IRA real estate investments for their retirement savings. What is a […]

Insolvency Not Bankruptcy Protects Debt Forgiveness

As we all know by now, when an individual owes a debt to another person or entity and the debt is forgiven, the canceled debt may be taxable. In the past, this general rule has applied to debt forgiveness related to a short sale. In 2007, Congress passed the Mortgage Debt Forgiveness Act (“MDFA”). The […]

Mortgage Forgiveness Debt Relief Act and the Fiscal Cliff (VIDEO)

Many credit the Mortgage Forgiveness Debt Relief Act for much of the housing industry’s recovery in Arizona and throughout the country. Under the IRS Tax Code, debt cancellation or debt forgiveness, such as mortgage forgiveness in a short sale, is considered regular “income” for the taxpayer. Under the code a taxpayer would essentially have to pay taxes […]